Preparing you for all Financial Aspects of your Retirement

FINANCIAL PLANNING | INVESTMENT MANAGEMENT

The cornerstone of our investment philosophy is risk management. Central to our philosophy is the vigilant recognition that Losses Hurt You More than Gains Help YouTM. This allows us to build a financial profile that is designed to protect against downside risk during periods of significant market fluctuations while also seeking growth opportunities during favorable market conditions. Finding creative ways designed to protect and grow client assets is our professional passion. We especially enjoy helping each new client piece together their retirement puzzle. Our specialty is creating focused investment strategies that are based on the investment objectives and risk tolerance of the client.

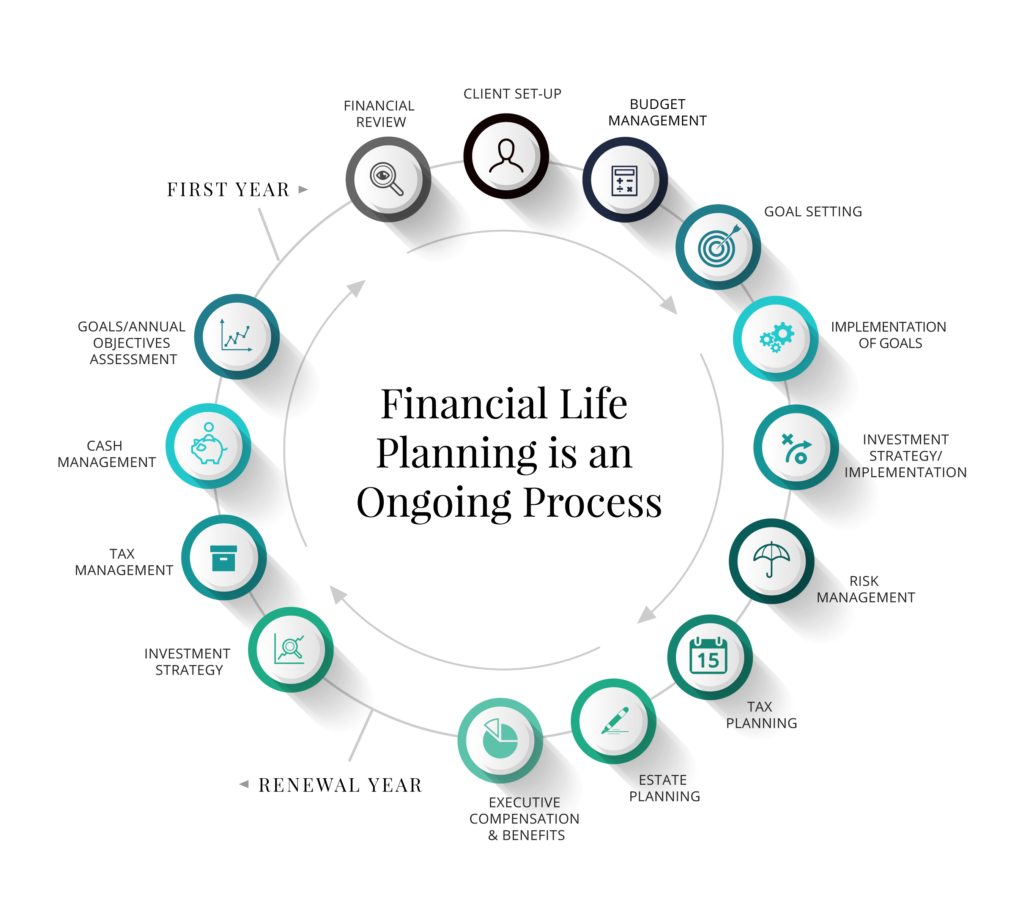

The most critical element to a successful retirement is your ability to have Income for Life. Our goal-based financial planning process is designed to help you obtain the income you need in order to meet the goals you have set for your retirement. One of those goals is for you to stay retired even during the inevitable market fluctuations that are common to our financial markets.

At Core Financial Management, we use proprietary investment strategies we call Private Wealth Strategies. Private Wealth Strategies are individually designed to address different objectives. When put together in a portfolio. The goal is to create a profile that is growth oriented while protecting downside risk during periods of market fluctuations.

Education | The first step towards planning your retirement is education. We offer an intensive, hands-on retirement planning class at different universities located throughout the Los Angeles metropolitan area. Those who attend one of our classes receive a free, no obligation, in-depth retirement plan.

Fiduciary | We are fiduciaries. A fiduciary is defined as a person who holds a legal and ethical obligation to act prudently and in the best interests of another person. Make sure that your retirement planning is in the hands of a fiduciary.

A fiduciary has 5 primary responsibilities. Those responsibilities are

Make sure your retirement planning is someone who adheres to these responsibilities.

Planning | A successful retirement is best enabled by one important factor: Income for Life.

Investments | Our motto: Losses Hurt You More than Gains Help YouTM